Depreciation methods sway a company’s reported earnings and valuation. Using this new, longer time frame, depreciation will now be $5,250 per year, instead of the original $9,000. That boosts the income statement by $3,750 per year, all else being the same. It also keeps the asset portion of the balance sheet from declining as rapidly, because the book value remains higher. Both of these can make the company appear “better” with larger earnings and a stronger balance sheet. One of the central aspects of straight-line depreciation is the concept of “useful life.” To depreciate your assets with this method, you need a good estimate of the useful life of the asset.

Straight-Line Method of Depreciation FAQs

There are several differences between accelerated and straight-line depreciation. Second, accelerated depreciation is more complicated to calculate than straight-line depreciation. And finally, accelerated depreciation is less likely to reflect the actual usage pattern of the underlying assets, while straight-line depreciation provides a better representation of usage.

How is straight-line method of depreciation calculated?

Depreciation is a versatile tool that serves various functions, from reflecting the economic reality of asset usage to offering tax benefits. Its application requires careful consideration of the chosen method and its implications on a company’s financial health and strategic planning. Understanding the basics of depreciation is essential for anyone involved in the financial aspects of a business.

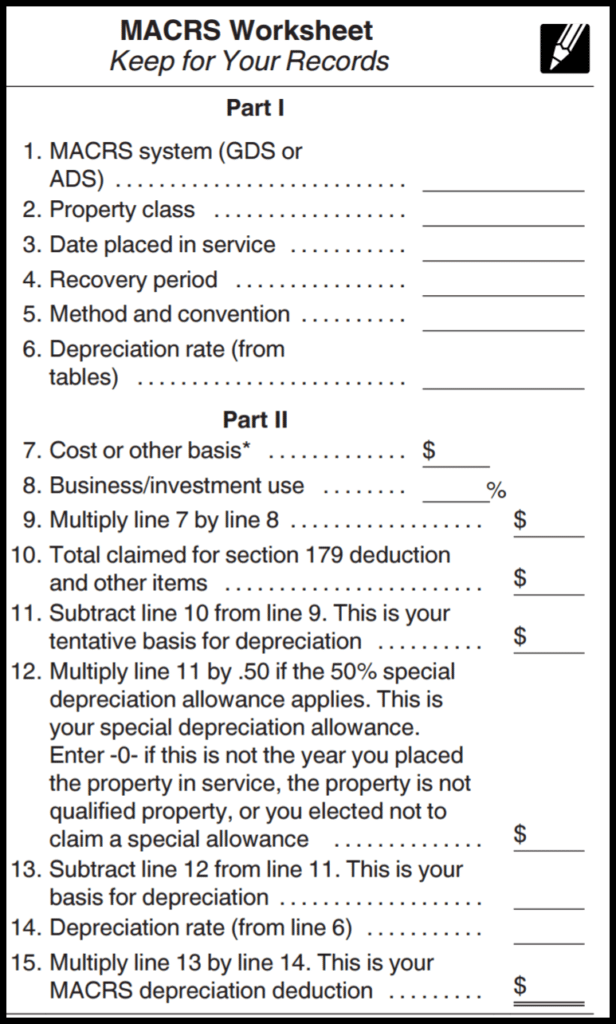

Modified Accelerated Cost Recovery System (MACRS):

The expected useful life is another area where a change would impact depreciation, the bottom line, and the balance sheet. Suppose that the company is using the straight-line schedule originally described. After three years, the company changes the expected useful life to a total of 15 years but keeps the salvage value the same. With a book value of $73,000 at this point (one does not go back and “correct” the depreciation applied so far when changing assumptions), there is $63,000 left to depreciate. This will be done over the next 12 years (15-year lifetime minus three years already). Because this tends to occur at the beginning of the asset’s life, the rationale behind an accelerated method of depreciation is that it appropriately matches how the underlying asset is used.

While the straight-line method is the easiest, sometimes companies may need a more accurate method. This means taking the asset’s worth (the salvage value subtracted from the purchase price) and dividing it by its useful life. Choosing a depreciation method requires thought about future taxes, asset types, desired cash flow, IRS compliance, and how it reflects in financial reports and asset management.

Are there limitations to the straight-line depreciation method?

- By writing off more assets against revenue, companies report lower income and thus pay less tax.

- When the book value reaches $30,000, depreciation stops because the asset will be sold for the salvage amount.

- Moreover, the straight line basis does not factor in the accelerated loss of an asset’s value in the short-term, nor the likelihood that it will cost more to maintain as it gets older.

- To get a better understanding of how to calculate straight-line depreciation, let’s look at a few examples below.

In contrast, accelerated depreciation methods like the declining balance or sum-of-the-years’-digits allow for larger deductions in the early years of an asset’s life. This front-loading of expenses can lead to significant tax savings initially but results in smaller deductions in later years. For instance, using a double declining balance method on the same $100,000 asset might result in a first-year depreciation expense of $20,000, double that of the straight-line method.

The asset’s cost subtracted from the salvage value of the asset is the depreciable base. Finally, the depreciable base is divided by the number of years of useful life. The key advantage of accelerated depreciation lies in its ability to unlock significant amounts of cash that the business would have otherwise straight line depreciation vs accelerated needed to wait to access. Based on the principle of ‘Time Value of Money’, money is more valuable today than in the future due to inflation and investment opportunities. The straight-line basis is also an acceptable calculation method because it renders fewer errors over the life of the asset.

Here’s a hypothetical example to show how the straight-line basis works. The equipment has an expected life of 10 years and a salvage value of $500. The straight line method on the other hand does not alter the performance of the business.

The double-declining balance (DDB) method is an accelerated depreciation method. After taking the reciprocal of the useful life of the asset and doubling it, this rate is applied to the depreciable base—also known as the book value, for the remainder of the asset’s expected life. Accelerated depreciation methods, such as double-declining balance (DDB), mean there will be higher depreciation expenses in the first few years and lower expenses as the asset ages.

To see this side by side, we get the following table using the same assumptions as before but with the added maintenance expenses. Calculation of Accelerated Depreciation is more complex with while the straight-line depreciation is simple and easy to understand. For example, if there is a machine that costs $100,000 and it can be used to produce 2 units of product per month for 5 years. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. 11 Financial is a registered investment adviser located in Lufkin, Texas.

Unlike more complex methodologies, such as double declining balance, this method uses only three variables to calculate the amount of depreciation each accounting period. Companies use depreciation for physical assets, and amortization for intangible assets such as patents and software. In the first article I wrote comparing the aggressive and conservative methods, I labeled accelerated depreciation as the aggressive method. Reason being that by quickly reducing the depreciation expense, later on, the net income increases only due to the account method. Computers do not have a long useful life, but five years is realistic and adequate.