The CFS is equally important to investors because it tells them whether a company is on solid financial ground. As such, they can use the statement to make better, more informed decisions about their investments. Since the income statement and balance sheet are based on accrual accounting, those financials don’t directly measure what happens to cash over a period. Therefore, companies typically provide a cash flow statement for management, analysts and investors to review. This disclosure is mandatory under both GAAPs and IFRSs as it may impact the economic decisions of investors and other stakeholders. As mentioned, operating activities are those that are used or generated by the day-to-day operations of the firm.

Statements of cash flow using the direct and indirect methods

While the direct method is easier to understand, it’s more time-consuming because it requires accounting for every transaction that took place during the reporting period. Most companies prefer the indirect method because it’s faster and closely linked to the balance sheet. However, both methods are accepted by Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). Once you have your starting balance, you need to calculate cash flow from operating activities.

Investing Cash Flow

- A balance sheet provides a snapshot of a company’s financial position at a specific point in time, detailing assets, liabilities, and shareholders’ equity.

- You must click the activation link in order to complete your subscription.

- Positive cash flow reveals that more cash is coming into the company than going out.

- Receive the latest financial reporting and accounting updates with our newsletters and more delivered to your inbox.

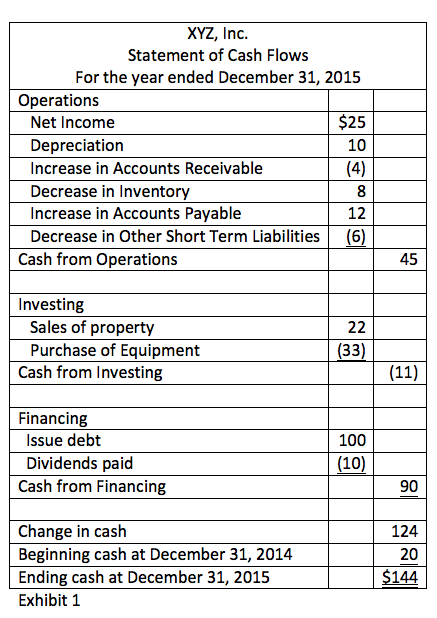

- Investing activity cash flows include making and collecting loans and acquiring and disposing of debt or equity instruments and property, plant, and equipment and other productive assets.

The increase (decrease) during the reporting period in the account that represents the temporary difference that results from Income or Loss that is recognized for accounting purposes but not for tax purposes and vice versa. The amount of cash paid during the current period to foreign, federal, state, and local authorities as taxes on income. IFRS Accounting Standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are best invoice management software to streamline ap process required to use them when reporting on their financial health. When using GAAP, this section also includes dividends paid, which may be included in the operating section when using IFRS standards. Interest paid is included in the operating section under GAAP but sometimes in the financing section under IFRS. As a different possibility, an asset account such as Equipment may have experienced more than one transaction rather than just a single purchase.

What Does a Negative Cash Flow From Financing Mean?

Potentially misunderstood and often an afterthought when financial statements are being prepared, it provides key information about an entity’s financial health and its capacity to generate cash. Now that you understand what comprises a cash flow statement and why it’s important for financial analysis, here’s a look at two common methods used to calculate and prepare the operating activities section of cash flow statements. A cash flow statement in a financial model in Excel displays both historical and projected data. Before this model can be created, we first need to have the income statement and balance sheet built in Excel, since that data will ultimately drive the cash flow statement calculations. CapEx investments might mean purchases of new office equipment such as computers and printers for a growing number of employees, or the purchase of new land and a building to house business operations and logistics of the company. These investments are a cash outflow, and therefore will have a negative impact when we calculate the net increase in cash from all activities.

This means a situation where the cash the company brings in is less than the cash it spends, with outflows being costs, investments, repayments, and the like and inflows being cash proceeds, sales, loans, and the like. In essence, management decides to spend more than it takes or earns, thus reducing the cash balance. In “Analyzing Statements of Cash Flows II,” a comparative approach is crucial for understanding cash flow trends over multiple periods. By examining changes in operating, investing, and financing activities, you can gain insights into how cash is generated and used within the company. This comparative analysis helps identify patterns in cash flow that indicate stability or areas where the organization may need to make adjustments.

Working capital represents the difference between a company’s current assets and current liabilities. Any changes in current assets (other than cash) and current liabilities (other than debt) affect the cash balance in operating activities. Amount of increase (decrease) from effect of exchange rate changes on cash and cash equivalents, and cash and cash equivalents restricted to withdrawal or usage; held in foreign currencies. Cash includes, but is not limited to, currency on hand, demand deposits with banks or financial institutions, and other accounts with general characteristics of demand deposits. Amount of increase (decrease) in cash, cash equivalents, and cash and cash equivalents restricted to withdrawal or usage; including effect from exchange rate change. Understanding cash flow statements can help you manage your business’s finances by revealing not just the amounts but also the sources and uses of cash.

HBS Online does not use race, gender, ethnicity, or any protected class as criteria for admissions for any HBS Online program. Our easy online application is free, and no special documentation is required. All participants must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the program. HBS Online’s CORe and CLIMB programs require the completion of a brief application.

This would impact the cash flows from investing activities section since there would be an additional cash receipt. The land cost $100,000 (given on the balance sheet) and there was a loss of $1,000 when it was sold (given on the income statement). If a fixed asset’s balance increases from one year to the next, it means that more must have been purchased and there was a cash outflow.

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. Receive the latest financial reporting and accounting updates with our newsletters and more delivered to your inbox.