For instance, when a company buys more inventory, current assets increase. This positive change in inventory is subtracted from net income because it is a cash outflow. There was no cash transaction even though revenue was recognized, so an increase in accounts receivable is also subtracted from net income.

Company A – Statement of Cash Flows (Alternative Version)

The cash flow statement takes that monthly expense and reverses it—so you see how much cash you have on hand in reality, not how much you’ve spent in theory. Using only an income statement to track your cash flow can lead to serious problems—and here’s why. Regardless of the method, the cash flows from the operating section will give the same result. Broadcast revenue declined $6.3 million, or 1.4% YoY, driven by lower spot revenue, partially offset by an increase in political advertising and non-cash trade revenues. Revenue from Sponsorship and Events increased by $0.8 million, or 1.7% YoY. Amount of increase (decrease) in prepaid expenses, and assets classified as other.

Cash Flow Statement: How to Read and Understand It

The purchasing of new equipment shows that the company has the cash to invest in itself. Finally, the amount of cash available to the company should ease investors’ minds regarding the notes payable, as cash is plentiful to cover that future loan expense. Negative cash flow should not automatically raise a red flag without further analysis.

What Does a Company Put in Its First Ever Cash Flow Statement?

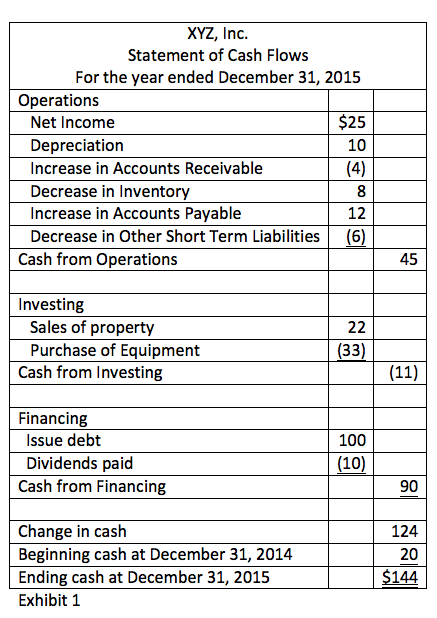

The statement of cash flows, also called the cash flow statement, is the fourth general-purpose financial statement and summarizes how changes in balance sheet accounts affect the cash account during the accounting period. It also reconciles beginning and ending cash and cash equivalents account balances. The first section of the cash flow statement covers cash flows from operating activities (CFO) and includes transactions from all operational business activities. The CFO section begins with net income, then reconciles all noncash items to cash items involving operational activities. A cash flow statement tells you how much cash is entering and leaving your business in a given period. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. Excluding the impact of political revenue, Revenue from Audio & Media Services increased by 13.7% for the three months ended September 30, 2024 compared to the three months ended September 30, 2023. See the end of this press release for a reconciliation of revenue, excluding political late fees and interest charges advertising revenue, to revenue. Operating expenses increased $0.6 million, or 1.4% YoY, primarily driven by higher sales commissions related to the increased demand for digital advertising. Amount of cash outflow for payment of an obligation from a lender, including but not limited to, letter of credit, standby letter of credit and revolving credit arrangements. Amount of expense (reversal of expense) for expected credit loss on accounts receivable.

- A company can use a CFS to predict future cash flow, which helps with budgeting matters.

- Once cash flows generated from the three main types of business activities are accounted for, you can determine the ending balance of cash and cash equivalents at the close of the reporting period.

- There are too many transactions to make it practical to look at each one individually to determine its impact on cash flow.

- Understanding how to create, interpret, and effectively use financial statements is pivotal for strategic decision-making.

This analysis is essential for stakeholders who are concerned with the company’s immediate financial health. The statement of cash flows can be used in a number of ways to assess firm performance by both internal and external financial statement users. Internal users can assess sources of and uses of cash in order to aid in adapting, as necessary, to ensure adequate future cash flows. Recall that comparing net income to operational cash flows can help assess the quality of earnings.

For non-finance professionals, understanding the concepts behind a cash flow statement and other financial documents can be challenging. Greg purchased $5,000 of equipment during this accounting period, so he spent $5,000 of cash on investing activities. Even though our net income listed at the top of the cash flow statement (and taken from our income statement) was $60,000, we only received $42,500. For most small businesses, Operating Activities will include most of your cash flow. If you run a pizza shop, it’s the cash you spend on ingredients and labor, and the cash you earn from selling pies. If you’re a registered massage therapist, Operating Activities is where you see your earned cash from giving massages, and the cash you spend on rent and utilities.

It provides an overview of cash used in business financing and measures cash flow between a company and its owners and creditors. The cash normally comes from debt or equity, such as selling stocks and bonds or borrowing from a bank. These figures are generally reported annually on a company’s 10-K report to shareholders. Positive cash flows within the CFI section, which can be generated in such ways as selling equipment or property, can be considered good. However, investors usually prefer that companies generate their cash flow primarily from business operations. Profitable companies can fail to adequately manage cash flow, which is why the statement is so important for prospective investors and business analysts.

By reviewing the statement, management can see the effects of its past major policy decisions in quantitative form. The statement may show a flow of cash from operating activities large enough to finance all projected capital needs internally rather than having to incur long-term debt or issue additional stock. Alternatively, if the company has been experiencing cash shortages, management can use the statement to determine why such shortages are occurring. Using the statement of cash flows, management may also recommend to the board of directors a reduction in dividends to conserve cash. A balance sheet provides a snapshot of a company’s financial position at a specific point in time, detailing assets, liabilities, and shareholders’ equity. In contrast, a cash flow statement focuses specifically on the movement of cash within an organization over a reporting period, categorizing cash activities into operating, investing, and financing activities.